Abstract

Introduction: The emergence of antigen downregulation following mono-specific CAR T cell therapy has driven clinical development of multi-specific CAR T cells. We conducted a single-institution Phase I dose-escalation study of CD19/CD22 bispecific CAR T cells and report long-term outcomes with a median follow-up of 3 years.

Methods and Results: We utilized lentiviral transduction of a bivalent CAR construct incorporating the FMC63 CD19 and M971 CD22 single chain variable fragments (scFvs) and 4-1BB costimulatory and CD3-zeta endodomains. Dose escalation was stratified by disease burden at enrollment, with high burden (HB) defined as ≥5% bone marrow lymphoblasts (flow cytometry or morphology), CNS disease and/or extramedullary disease and low burden (LB) defined as <5% bone marrow lymphoblasts, not otherwise meeting HB criteria. All patients received lymphodepletion chemotherapy with fludarabine and cyclophosphamide, as prescribed by study protocol.

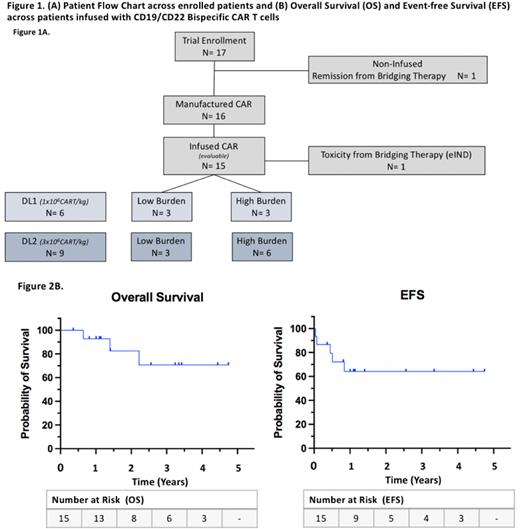

Seventeen patients were enrolled and 15 patients were infused on study across the first two dose levels of 1x106 (DL1; N=6) and 3x106 (DL2; N=9) CAR T cells/kg (figure 1). Infused patients had a median age of 13 years (range; 2-21) at infusion, with a female to male ratio of 2:3. Four patients had received prior HSCT.

Overall, CD19/CD22 bispecific CAR T cell therapy was very well tolerated, with no dose limiting toxicities experienced at DL1 or DL2 across HB and LB cohorts. Ten of 15 patients (67%) experienced CRS, with only one patient experiencing ≥ grade 3 CRS (Grade 1, N=5; grade 2, N=4; grade 3, N=1). Four patients with ≥ grade 2 CRS received tocilizumab (DL1; N=2, DL2; N=2), and one patient with grade 3 CRS with hypotension required norepinephrine. Of patients with CRS, 7 of 10 (70%) had HB disease. No patients experienced ICANs.

Fourteen of 15 infused patients (93%) achieved morphologic complete response (CR), with 13 of 15 (87%) achieving negative minimal residual disease (MRD) by flow cytometry. With a 3-year median follow-up (37 months; range 4-57 months), five patients (33%) experienced morphologic or flow cytometric relapse (CD19+/CD22+; N= 4, CD19-/CD22+; N=1) and 3 (20%) died (Progressive B-ALL; N=2, HSCT-related mortality; N=1). Twelve of 15 patients (80%) received post-CAR HSCT, 3 following relapse and 9 while in remission (Early loss of BCA (≤3mo); N=5, Pre-emptive HSCT with ongoing BCA; N=4). Median time to HSCT across 9 patients receiving HSCT while in remission was 2 months (range, 1-6). Among 3 patients not receiving HSCT post-CAR, one relapsed at 6 months, one has ongoing CR and BCA at 9 months and one remains in remission at 4 months post-infusion after early loss of BCA (<3mo). Event-free survival (EFS) is 64% at 1 year, with EFS achieving a plateau after 1 year. Overall survival is 93%, 83% and 71% at 1, 2, and 3-years respectively. Multi-omic correlatives identifying features of baseline exhaustion as they relate to peak CAR expansion are ongoing and will be presented.

Conclusion: CD19/CD22 CAR T cells demonstrate efficacy with a morphologic CR rate of 93% and favorable long-term OS and EFS when coupled with HSCT. We report good tolerability across LB and HB relapsed/refractory B-ALL at 3x106 CAR T cells/kg dosing. Study of further dose escalation is ongoing.

Disclosures

Schultz:Novartis: Membership on an entity's Board of Directors or advisory committees. Majzner:Syncopation: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Link Cell Therapies: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Lyell Immunophama: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Innervate Radiopharmaceutics: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Immunai: Consultancy; NKARTA: Consultancy; Aptorum Group: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Fate-DSMB: Consultancy. Frank:Adaptive Biotechnologies: Consultancy, Honoraria, Research Funding; Roche/Genentech - Wife: Current equity holder in private company, Current holder of stock options in a privately-held company; Kite/Gilead: Honoraria, Research Funding; Allogene Therapeutics: Research Funding. Miklos:Kite, a Gilead Company: Research Funding; Adaptive Biotech: Consultancy; Bristol Meyers Squibb: Consultancy; Novartis: Consultancy; Pharmacyclics: Patents & Royalties: cGVHD Ibrutinib patent ; Janssen: Consultancy, Honoraria; Allogene: Research Funding; Fosun Kite: Consultancy, Honoraria. Feldman:Fresh Wind Bio: Consultancy; Alaunos: Consultancy; Syncopation Life Sciences: Honoraria, Other: Sponsored Research. Mackall:Mammoth: Divested equity in a private or publicly-traded company in the past 24 months; Immatics: Consultancy; Nektar: Consultancy; Syncopation: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Ensoma: Divested equity in a private or publicly-traded company in the past 24 months; Link: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Medimmune Tech: Consultancy; BMS: Consultancy; Apricity: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; Lyell Pharmaceuticals: Consultancy, Divested equity in a private or publicly-traded company in the past 24 months; GSK: Consultancy.

Author notes

Asterisk with author names denotes non-ASH members.

This feature is available to Subscribers Only

Sign In or Create an Account Close Modal